Spousal IRA: How Does It Work?

A Guide To Understanding The Benefits and Uses of a Spousal IRA

The Individual Retirement Account, or IRA, is a retirement savings account that allows individuals to save and invest money for retirement on a tax-deferred basis. There are two primary types of IRAs: Traditional and Roth.

In a traditional IRA, you generally get a tax deduction for your yearly contributions on your tax return, but the proceeds are taxed as ordinary income when they are withdrawn. In a Roth IRA, you cannot take a tax deduction for your yearly contribution, but the contributions and investment growth are generally 100% tax-free when used in retirement.

IRA accounts must be owned by individuals and cannot be held jointly by spouses. Additionally, contribution rules for IRAs state that an individual must have earned income to contribute to an IRA in a given year. The IRS provides a unique planning opportunity for spouses with little or no income – The Spousal IRA. Spousal IRAs grant an exception to this earned income provision, so as long as either one of the spouses has adequate income, contributions can be made for the nonworking spouse to their IRA.

What is a Spousal IRA?

A Spousal IRA is nothing more than a standard IRA that allows a non-working spouse to contribute even if they have little or no earned income. Functionally, the working spouse contributes on behalf of the non-working spouse. To be eligible for a spousal IRA, a couple must file their taxes as Married Filing Jointly (MFJ) on their tax return. Therefore, this is not an option if the individuals are Married Filing Separate (MFS), or unmarried and still filing two separate single returns.

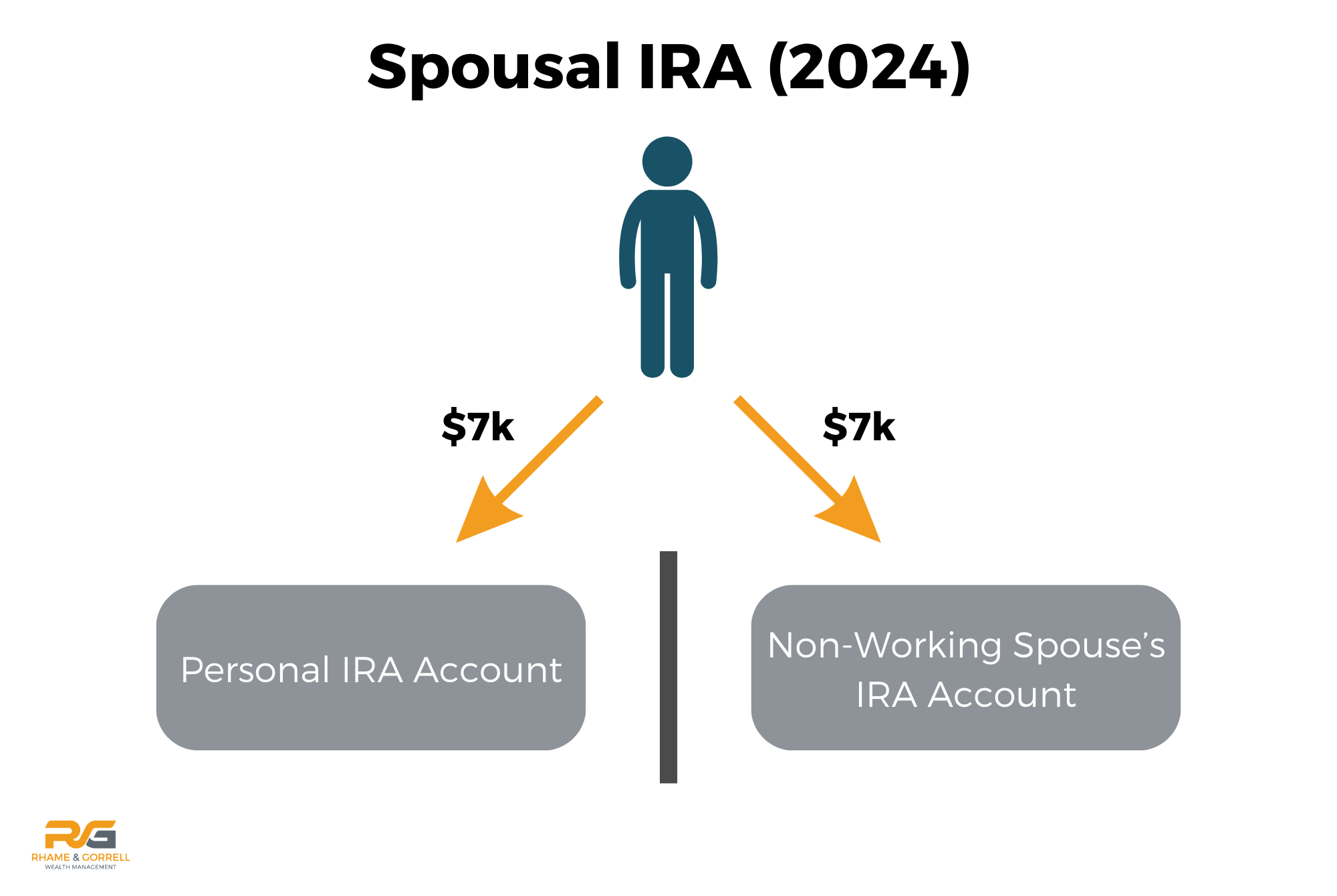

A spousal IRA can be set up as either a Traditional or Roth IRA. These spousal IRAs are subject to all the same contribution limits, income limits, pro rata rules, and catch-up contribution provisions as normal Traditional and Roth IRA accounts. The benefit of contributing to a Spousal IRA is that it allows a couple to double their annual retirement savings. Instead of one spouse’s annual limit contribution of $7,000, the couple can put away $14,000 annually.

Contribution and Income Rules

The annual contribution limit to a Traditional or Roth IRA is $7,000 per person ($8,000 if you are 50 or older). There are somewhat complex income limits on Roth IRA contributions that are important to note, however. If your Modified Adjusted Gross Income (MAGI) is under $230,000 for 2024, you will be able to make the entire Roth IRA contribution. After that income level, as MAGI increases to $240,000, Roth IRA contributions become disallowed (see our Backdoor Roth IRA guide for high-income individuals).

If a non-working spouse has previously worked and set up an IRA, this can be used for the spousal IRA contributions. There is no need to set up a new IRA account. If the non-working spouse has never owned an IRA account, they will need to open their own Traditional or Roth IRA for spousal contributions.

Tax-Deductibility Phase-Out

There are some additional complexities to deducting IRA contributions if you are also a participant in an employer retirement plan like a 401(k) or 403(b). For Spousal Traditional IRA contributions where neither spouse is covered by a workplace retirement plan, the yearly contributions will always be tax deductible. If a retirement plan at work covers the working spouse, this creates a phase-out range on the tax deductibility of these Traditional IRA contributions.

For 2024 this phase-out range is between $123,000 to $143,000 of MAGI. Below $123,000, the contributions will continue to be tax deductible. Above $143,000, none of the contributions will be tax deductible.

In between $123,000 and $143,000, the tax deduction is limited. If the contributing spouse is not covered by a retirement account and their spouse who makes little to no income is covered by a retirement plan, the phase-out range increases: $230,000 to $240,000.

It’s important to note that just because you cannot take a tax deduction for the traditional IRA contribution, it does not mean you cannot make a contribution. You can make a non-deductible IRA contribution to your traditional IRA account by making your normal annual contributions, filling out Form 8606, and sending it in with your tax return. Please discuss this with your accountant to capture non-deductible IRA contributions correctly.

In this case, you may wish to consider the Backdoor Roth IRA for nondeductible contributions, as Spousal IRAs are eligible for Backdoor Roth conversions.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) professionals regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers can help you review your financial and tax situation and come up with a custom tax optimization strategy going forward.

Feel free to contact us at (832) 789-1100, [email protected], or click one of the buttons below to ask a question or schedule your complimentary strategy session today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.